Areas we Serve

Medicare Advantage Plans

Medicare Advantage Plan in Mineral Wells, Texas 76067

If you’re in Mineral Wells, Texas 76067, and seeking the best Medicare Advantage plan, the process can feel daunting. We understand the confusion that comes with various options available. Rest assured, we are here to offer guidance in selecting a plan that aligns with your specific healthcare requirements. Your well-being is our priority.

We work with top Medicare providers

Turning 65 is a significant milestone in Mineral Wells, Texas, as it marks the eligibility for Medicare. Selecting the right Medicare Advantage plan is crucial in ensuring cost-effective healthcare choices. With the abundance of options available, seeking expert guidance can simplify the process and provide reassurance in making informed decisions. By taking the time to navigate through the enrollment process with guidance, individuals can feel supported and confident in their healthcare choices as they embark on this new chapter in their lives.

How does Medicare work?

Medicare is a federal health insurance program primarily for individuals aged 65 and older, though certain younger individuals with disabilities or specific conditions may also qualify. Medicare is divided into four parts: A, B, C, and D.

More on Medicare plans:

Medicare Plan A

Medicare Part A covers

- Inpatient hospital stays

- Skilled nursing facility care

- Hospice care

Medicare Plan B

Medicare Part B covers

- Outpatient care, doctor visits

- Preventive services

- durable medical equipment

Medicare Plan D

Medicare Part D provides

- Rescription drug coverage and is available as a standalone plan or included in some Medicare Advantage plans.

What is the medicare advantage plan ?

A Medicare Advantage (Part C) plan is a private insurance alternative to Original Medicare (Parts A & B). These plans are offered by Medicare-approved private companies and often include additional benefits like dental, vision, and prescription drug coverage.

According to Medicare.gov, Medicare Advantage plans may offer extra benefits beyond Original Medicare, such as dental and vision coverage.

How Does It Differ from Original Medicare?

Original Medicare covers hospital and medical services but lacks additional benefits. Medicare Advantage plans bundle these services and often include perks like gym memberships, wellness programs, transportation services, and meal delivery benefits.

Do I need a Medicare Advantage Plan in Mineral Wells, Texas?

If you want more comprehensive coverage than Original Medicare offers, including prescription drugs and additional benefits, a Medicare Advantage plan may be the right choice. Many plans offer lower out-of-pocket costs and extra services that can improve your overall healthcare experience.

Who is eligible for Medicare Advantage In Mineral Wells, Texas?

To enroll in a Medicare Advantage plan, you must:

- Be enrolled in Medicare Parts A and B.

- Live in Mineral Wells.

What are the costs of Medicare Advantage in Mineral Wells, Texas?

The cost of Medicare Advantage plans in Mineral Wells varies depending on the provider and level of coverage. Some plans have a $0 premium, while others require a monthly payment. Additional costs include:

- Deductibles

- Copayments

- Coinsurance

- Out-of-pocket maximum limits

When to Enroll for a Medicare Advantage in Mineral Wells, Texas?

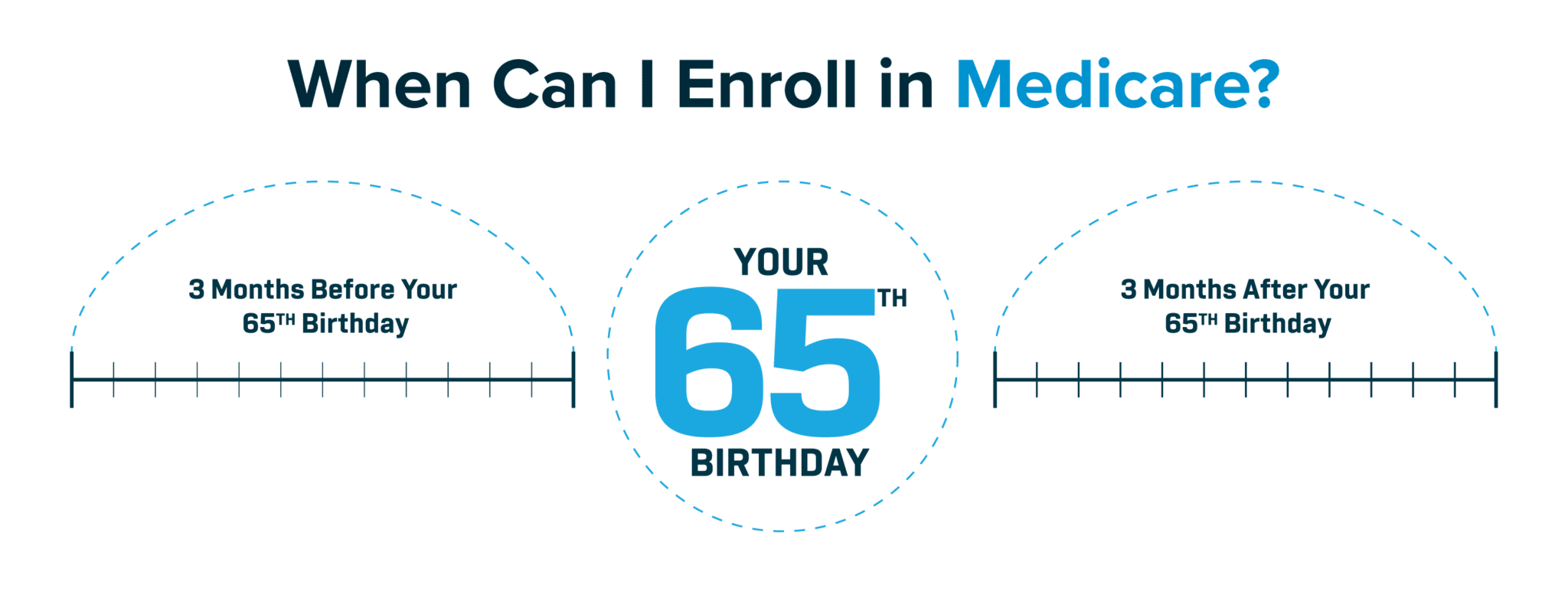

Enrolling in a Medicare Advantage plan requires meeting specific enrollment period guidelines.

Enrolling for the 1st time?

- Initial Enrollment Period

This is a seven-month window that begins three months before your 65th birthday, includes your birth month, and extends three months afterward.

- General Enrollment Period

If you missed your Initial Enrollment Period, you can sign up during the General Enrollment Period, which runs from January 1 to March 31 each year.

- Special Enrollment Period

If you qualify due to specific life events, such as losing employer coverage or moving to a new service area, you may be eligible for a Special Enrollment Period.

Changing Plans

- Annual Enrollment Period

From October 15 to December 7 each year, Medicare beneficiaries can switch, drop, or enroll in a new Medicare Advantage plan.

What are the different Medicare Advantage plans?

- Health Maintenance Organization (HMO)

– Requires members to use a network of doctors and hospitals.

- Preferred Provider Organization (PPO)

– Offers flexibility in choosing providers, with lower costs for in-network services.

- Private Fee-for-Service (PFFS)

– Allows visits to any Medicare-approved provider that accepts the plan’s payment terms.

- Special Needs Plans (SNPs)

– Tailored for individuals with chronic illnesses or specific healthcare needs.

What our clients say

We have helped more than 300 clients across all the cities and counties of Texas, hers are how they think of us.

How to apply to a Medicare Advantage plan in Mineral Wells, Texas?

To apply for a Medicare Advantage plan in Mineral Wells, Texas, connect with a licensed agent who can offer guidance and support.

We have the right plan for you!

Finding the perfect Medicare Advantage plan in Mineral Wells, Texas can feel overwhelming, but it doesn’t have to be stressful. With options like low premiums, comprehensive coverage, and extra benefits such as dental and vision, we are here to guide you through the process with support and expertise. Let us help match you to a plan that suits your unique needs, budget, and lifestyle. Take the first step towards peace of mind and find the right plan today.